Inspired by a few things, I had a little look into the Beveridge Curve recently. As the links will show, in the US something curious has happened to the Beveridge Curve since around the middle of 2008. It appears to have shifted right dramatically:

Some of the commentators in the links have asserted that the change happened after the US government extended the duration of unemployment benefits, although others have noted that even taking into account the theoretically most generous impact of this duration change would not explain all of the movement.

David Andolfatto appears to be on to something, comparing this shift in the Beveridge Curve to previous shifts in Beveridge Curves towards the end of recessions.

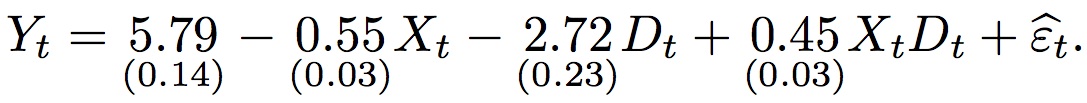

I've done a couple of things. First I've looked into the data. If one wants to spin an unemployment benefits story, one can. Simply put in dummy variables into a simple Beveridge curve regression; we get something like:

Here, Y is the vacancy rate, X is the unemployment rate. Standard errors are in parentheses. Clearly, if one wants to sell a structural break story, one can: Both the impact on the intercept (via dummy D_t) and the slopt (via the interaction of D and X) are strongly significant. The resulting regression lines look like:

Hence the intercept falls in size dramatically, as does the slop of the curve. Had this happened, it would be really scary stuff: Much higher unemployment rates would be able to coexist with very small declines in the vacancy rate.

However, a regression such as that just run suffers from many, many econometric problems. Not least both the unemployment rate and the vacancy rate bear all the hallmarks of non-stationary, unit-root time series, and hence a static regression of one on the other, as just carried out, could well be spurious. Additionally, there are many recognised factors that might shift the Beveridge Curve relationship, without affecting its slope. Economically plausibly, things other than the duration of benefits may have contributed to the scatter plots observed for the Beveridge Curve.

To investigate these possibilities we must specify a model that includes a number of lags of the relevant variables, and also extends the set of relevant variables from just the unemployment rate to other variables capturing the efficiency of the matching process (the current hiring rate for example could be a proxy), the level of long-term unemployed (proxy by those unemployed over 27 weeks), the level of frictional unemployment (those unemployed less than 5 weeks), and the level of labour mobility as well as simply the level/duration of benefits and the level of productivity and labour costs. This means a very large regression model.

However, one can employ an automatic model selection procedure called Autometrics (in OxMetrics 6) to help. This software is based on the General-to-specific methodology of Sir David F. Hendry and seeks to select the simplest possible model from an initially large model with many candidate explanatory variables. Such a procedure of model selection would actually find that the 2008 US legislation change to extend unemployment benefits was entirely uninformative for explaining the evolution of the Beveridge Curve, and would actually find a curve with a slope somewhere in-between the two found above, but a curve that is shifting left and right with labour mobility, with long-term unemployment and other factors. I'll save you the details, but I'm writing it up currently, and just plot you the following to give you some idea what was found:

The black line is the Beveridge Curve found after the more detailed econometric investigation allowing for factors that shift the Beveridge Curve. Hence one can see that without these additional variables we have not necessarily identified the Beveridge Curve just by eye-balling the scatter plot. We need to do serious econometric analysis based on economic theory, helpfully augmented by Autometrics, if we are to understand more of what is going on.

However, if you are simply informed by plots and not complicated econometric analysis, an alternative consideration of a scatter plot of the vacancy level and unemployment level in the UK over roughly the same time period may be more persuasive of the idea that it is not unemployment benefits causing what we've seen recently (since there has been no similar increase in the duration of benefits):

All in all, I'm going for the "it's not a structural break caused by the duration of benefits" story, along the lines of that proposed by David Andolfatto.